Introduction

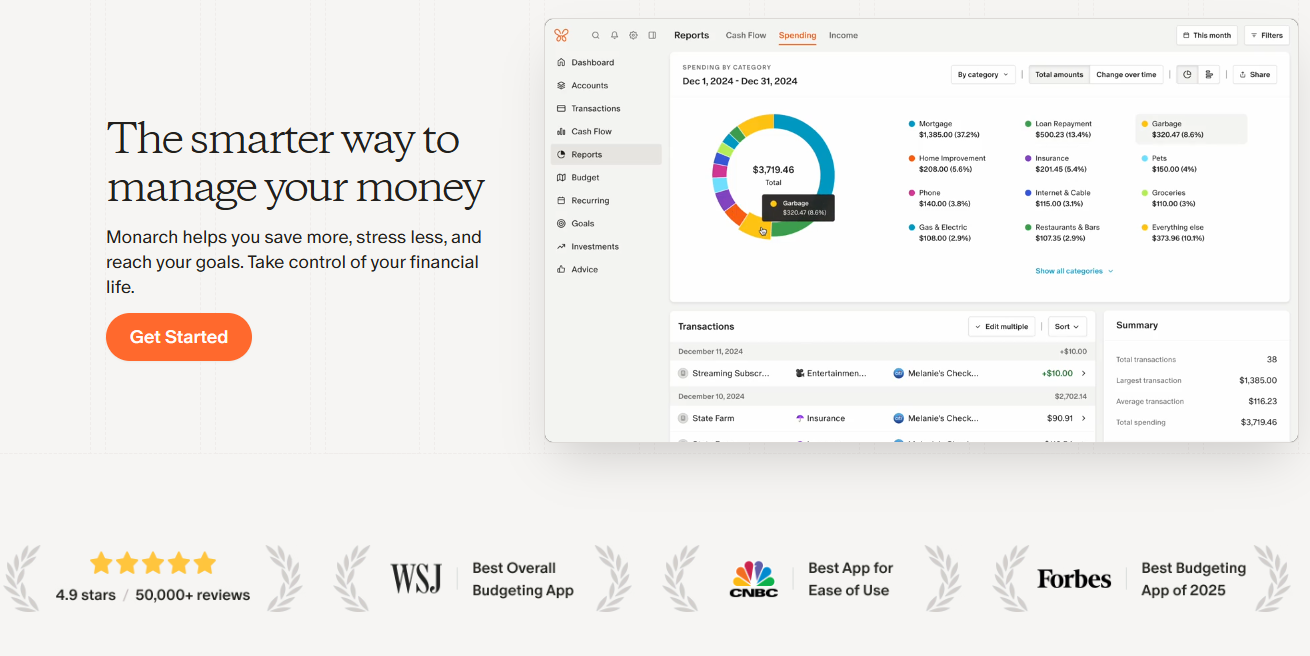

Stuck under messy spreadsheets, neglected subscriptions, and fuzzy cash flow? For online entrepreneurs, bloggers or small business owners, managing finances might be the last of your favorite thing to do which takes time away from building your hustle. Enter Monarch Money, a sexy new budgeting app whose tagline is, “The smarter way to manage your money,” and which vows to simplify your financial life. It consolidates all your accounts, monitors spending, and helps you crush savings goals — great for busy pros who want some clarity, stat. But is it still the best budgeting app for 2025? Game-changer hai kya? In our Monarch Money review, we’ll cover the features, pricing and more to see if this is the financial hack you’ve been waiting for. Chalo, let’s dive in!

What is Monarch Money?

Monarch Money is a financial app that provides a single dashboard for your financial accounts – bank, credit cards, investments, loans, and yes even crypto – for you to track in real time. Officially launched in 2021, it is already loved by over 30,000 Redditors and hailed as the “Best Budgeting App” by the Wall Street Journal. Its customizable tools allow you to budget, set goals and work with partners or advisers, which has made it a favorite among couples and entrepreneurs. With integrations to 13,000+ financial institutions, it’s a newer Mint alternative (though not as feature-rich) for startups and freelancers.

Top Features & Benefits

Monarch Money comes with feature heavy functionalities to help bloggers, entrepreneurs, and small business make the best of their finances. Here are six main features of this product and the benefits:

- Net Worth Trackin: Syncs all accounts bank, investments, real estate to provide a clear snapshot of your wealth and helps entrepreneurs track wealth growth.

- Flexible Budgeting: Provides flexible budgets – a flex budget (I don’t know how to make it work here :-)) or a category budget, that can adapt to your lifestyle, exactly what a freelance writer on unpredictable income needs.

- Goal Planning: Establish savings goals (i.e., emergency fund, vacation), keeping early startups accountable to big wins.

- Recurring Bill Detection: Automatically find subscriptions and bills, to avoid unexpected and forgotten charges for small businesses.

- Shared Tools: The ability to share accounts with partners or advisors at no additional charge (perfect for couples who have side hustles).

- Custom Reports: Show spending on charts (eg Sankey diagrams), providing entrepreneurs with insights to reduce costs.

I have a friend who runs a small e-commerce startup and used Monarch Money for recurring expenses to cut its subscription costs by 15%. It has an intuitive design, users rate it 4.8 out of 5 on Google Play. One App Store review gushed, “I love everything about this app. Creating a budget is easy, seeing your spending is great, and ALL THE THINGS I want in an app this can do! So easy and flexible.” “Monarch is a lot better than Mint,” said another user. The connections to institutions are more stable.”

Pricing & Value

Monarch Money does not have a free plan, but it offers a 7-day free trial (30 days for ex-Mint users with code WELCOME30). It offers two paid plans — monthly and annual subscriptions, with a 30% discount for new members who use code WELCOME. Here’s what just the homepage offers:

Pricing Table

| Plan Name | Price | Features | Best For |

|---|---|---|---|

| Monthly | $14.99/month | Full access, ad-free, 13,000+ integrations | Freelancers, Bloggers |

| Yearly | $99.99/year ($8.33/month) | Same as Monthly, 30% off with code WELCOME | Startups, Couples |

The Monthly plan is great for freelancers trying the waters and the Yearly plan provides a discount for a serious start up who is in long term. At $8.33/month (annual), it’s not as cheap as competitors like Rocket Money’s free tier but much cheaper than hiring a bookkeeper. For affiliate marketers, its spending insights can help maximize ad budgets and ROI. Given Mint’s ads and lack of syncing, Monarch’s ad-free experience combined with its syncing are justification for the expense. Sign up for Monarch Money, and you can try it out for free here: Monarch Money Sign-Up

Pros & Cons

It is time to get real about Monarch Money

Pros:

- Full Financial Picture: Sync 13, 000+ financial accounts rated 4.8/5 by users for connectivity.

- Custom Built: Diverse budgets and dashboards cater to every entrepreneur with ratings at 4.9/5 on the App Store.

- Ad-free: Clean interface, no pop-ups, unlike free apps.

- Partnership: All partner/advisor access that is free, excellent for couples or small teams.

- Safe: Bank-level security protects sensitive business finances when using the app.

Cons:

- No Free Tier: Prices starting at $14.99/month or $99.99/year might spook the penny pinchers in the group.

- Weak Crypto Integration: You can only sync your account with Coinbase among the exchanges, which is not optimal for crypto-heavy entrepreneurs.

- Short Trial: 7-day trial (or 30-day with code) doesn’t provide much time to test it completely.

Monarch Money is a financial beast, but the cost and lack of support for some cryptos may bug some people. Still, its qualities help make it a top choice.

Who Should Use Monarch Money?

Monarch Money is ideal for freelancers, bloggers and startups who want a clearer vision of their finances. Bloggers may track ad revenue and expenses, while startups use goals tools to set aside money to scale. Business-running couples appreciate its shared access for joint budgeting. For example, a friend’s SaaS startup employed Monarch Money to kind of track their cash flow, watching their savings grow month over month by 10%. Its bill reminders help small businesses steer clear of late fees.

Casual users with basic budgets or anyone who wants advanced crypto tracking (it only supports Coinbase) won’t be too thrilled with it. Non-digital businesses, such as a retailer, could see it as overkill. But for digital business owners, Monarch Money is a need — to simplify their money and to scale it.

Conclusion & Call-to-Action

Monarch Money, a 2025 top budgeting app, synchs 13,000+ accounts, provides budgeting flexibility and ad-free clarity to entrepreneurs, bloggers, and startups. Its customizable dashboards, goal-tracking functions and collaboration tools make it a Mint-killer, and can save you time and optimize your savings. With a 7-day free trial and 30% off your first year (code: WELCOME), it’s a low risk way to take control. In the case of affiliate marketers, it also maximizes spending for increased profits. Ready to worry less about money and start saving? Try Monarch Money for FREE today and become one of 30,000+ satisfied customers! MONARCH MONEY SIGN-UP

Affiliate Disclosure

This post contains affiliate links, meaning DigitalToolPro.com may earn a small commission on purchases made through them, at no additional cost to you. We only recommend tools that benefit entrepreneurs, bloggers, and small businesses like yours—thank you for your support!