Introduction

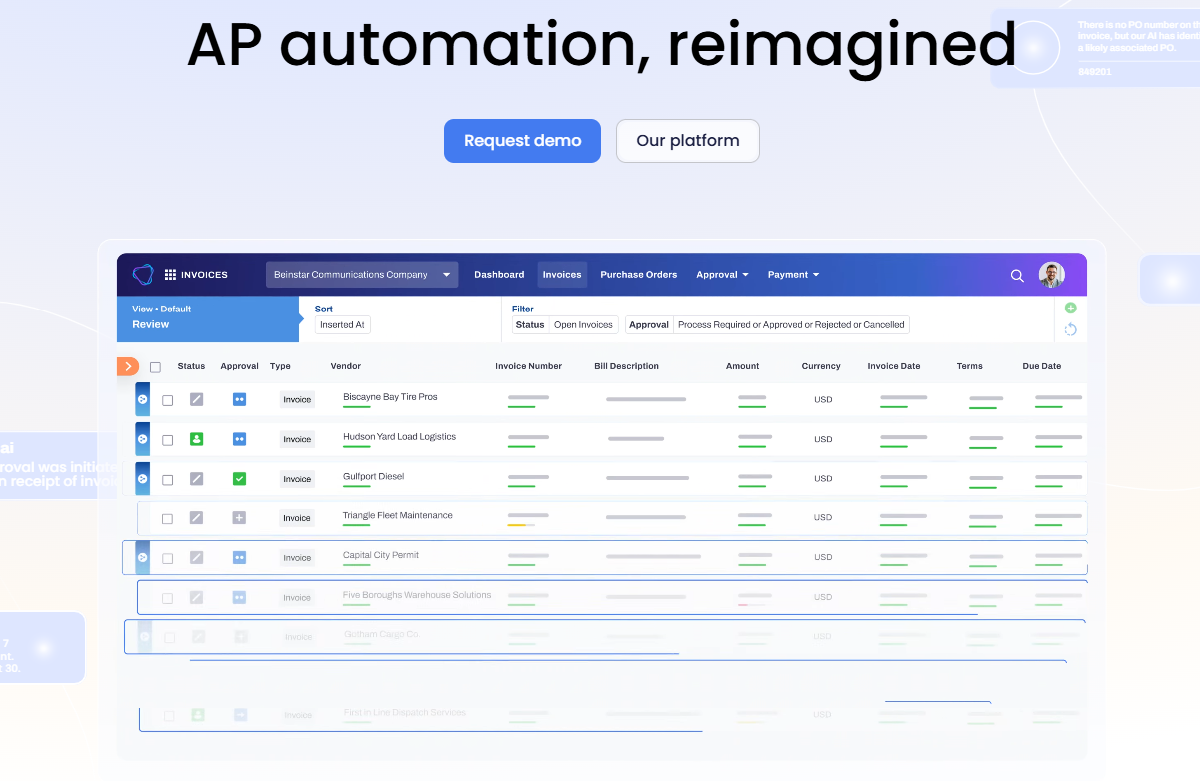

Sick of being swamped with invoices or with your finance team slogging through data entry? As an entrepreneur, side-hustling blogger or small business owner, you also know how accounts payable (AP) headaches, can strangle your ability to grow. Say hello to Vic.ai, the AI-driven platform that claims it will automate your AP process, reduce errors, and save you hours. In this Vic.ai review for 2025, we’ll walk you through its features, pricing, and whether it’s a good fit for your business. Ideal for getting financial stuff in order, Vic.ai is essential to bloggers who are scaling their merch shop or businesses working to future-proof their AP. Let’s jump in and see if it lives us to all the hype!

What is Vic.ai?

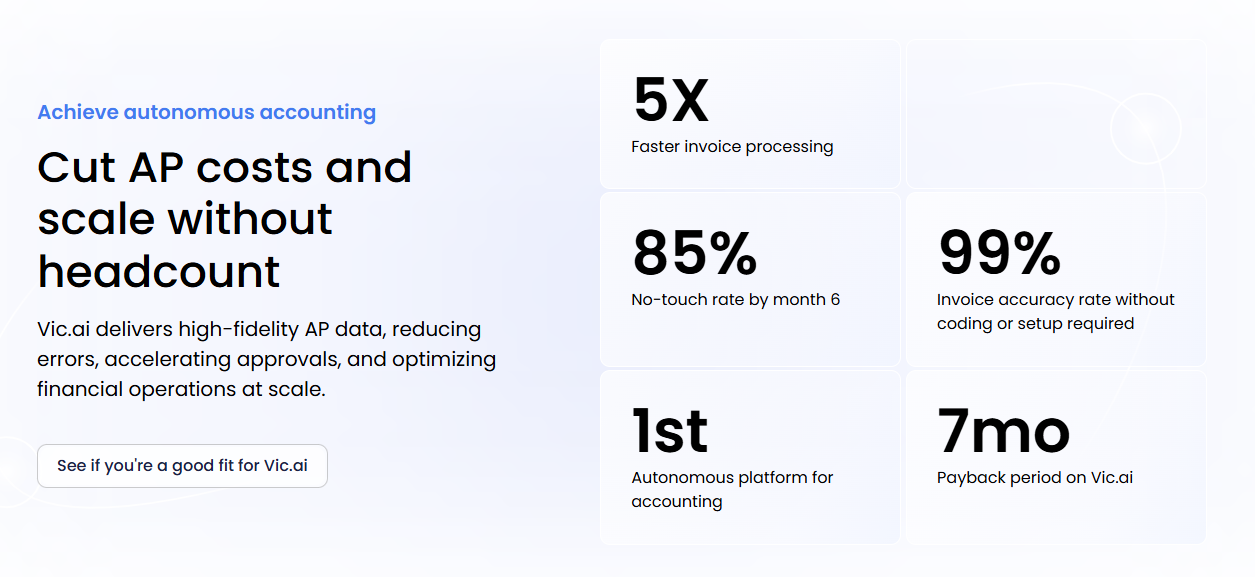

Vic.ai is an AI-first autonomous finance platform on a mission to transform Accounts Payable through cutting-edge automation. Its tagline, “Cut cost, increase accuracy and scale smarter with AI-first accounting,” says it all. From purchase orders to bill payments, Vic.ai brings together AI trained on 1+ billion invoices to achieve 99% accuracy and process with 85% no-touch by month six. Big corporate names such as Diesel Direct and Stonewall Kitchen trust it, according to its website. My friend Priya, who is a startup founder in the logistics space, is wild about Vic.ai — it would have reduced the time it takes her team to process AP by 80%, and would repatriate hours to that team every week. Vic.ai is a favorite among finance teams, founders and small business owners who seek to minimize the time they spend on AP work and instead focus on growing their companies.

To expand, Vic.ai processes over $30 billion in spend across 10,000+ clients, saving them $188 million and six million hours, as per its website. Its AI eliminates outdated template-based systems, offering a scalable solution for industries like logistics and retail.

Top Features & Benefits

Vic.ai is rich in features and a top choice for finance teams, expense management bloggers, and growing small businesses alike. Here’s what you get:

- Invoice Processing: AI pulls data and codes GL entries, processing invoice with 99% accuracy, and reducing manual work. Perfect for entrepreneurs managing high number of invoices.

- PO Matching: Automatically matches from purchase orders to invoices, and identifies mismatches instantly. Saves time for small businesses handling complicated orders.

- Approval Flows: Automates approvals with AI-based routing to speed up bottlenecks. Ideal for bloggers with team-based spending approval.

- VicPay & Vendor Portal: Interfaces with ACH, check, virtual card and gives vendors self-service nature; dashboards leads to improved cash flow. Ideal for enterprises that are streamlining vendor relationships.

- VicCard Expense Management: Real-time non-payroll expense tracking with AI insights. A life saver for start ups managing to control the costs.

- Analytics & Insights: Delivers real-time dashboards of AP performance, spend and trends to inform data-driven decisions. Critical for growth and scaling.

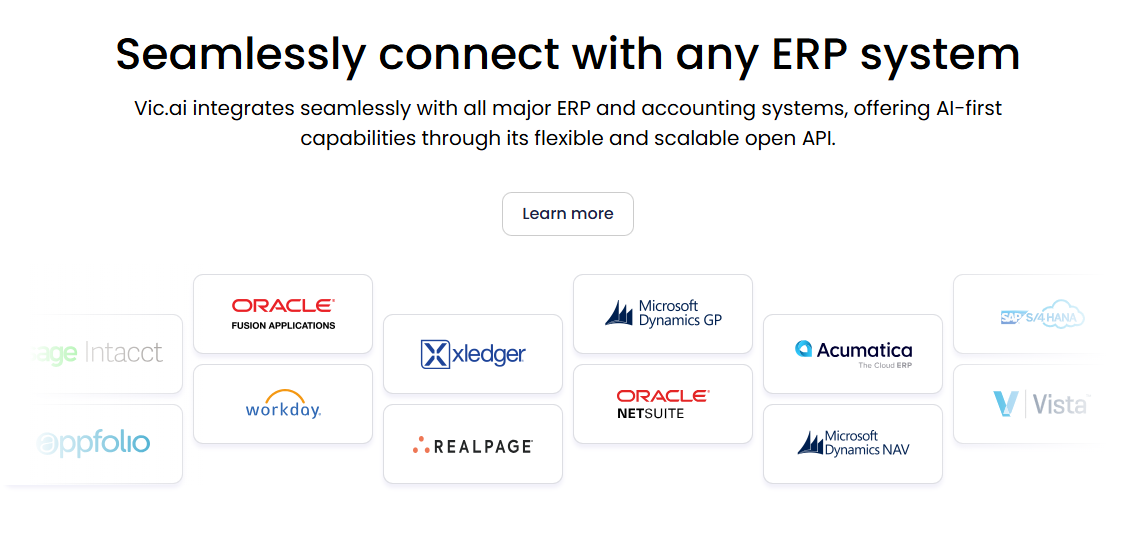

These are the features that increase efficiency, reduce costs and spare time. For instance, Diesel Direct’s AP team saved 3–6 hours per week per analyst by eliminating manual payment work with Vic.ai. Users love it: “The difference maker with Vic.ai is the sophisticated AI technology. Unlike many other vendors who actually heavily template-based, their platform has enabled us to do away with templating altogether,” said Paul Dachsteiner, VP of IT at Stonewall Kitchen. Another user noted, “Vic.ai = saved us $188 million 6 million hours over 10,000+ clients.” Vic.ai, with ERP integrations such as NetSuite, QuickBooks, bushes the company optimizes every aspect of your AP process.

Additionally, Vic.ai’s VicInbox automates email management, prioritizing tasks and integrating with ERPs, which streamlines communication for busy AP teams. Its continuous learning AI adapts to unique business needs, boosting accuracy over time.

Pricing & Value

Vic.ai does not list public pricing, and you’ll need to get a quote from the vendor based on your business size and requirements. According to intelligence on the web, the plans start at $500/month for small business, and the enterprise pricing goes higher. A free trial is offered, so you can try it out without any risk. Here’s a rough breakdown:

| Plan Name | Price (per month) | What You Get | Best For |

|---|---|---|---|

| Starter | $500+ | Invoice processing, basic analytics, ERP integration | Bloggers, solopreneurs |

| Pro | $1,200+ | PO matching, VicPay, advanced analytics | Small businesses, growing firms |

| Enterprise | Custom | Full suite, VicCard, multi-entity support | Large companies, multi-entity firms |

When compared to the cost of employing an AP clerk ($3,000+/month), Vic.ai is an inexpensive way to automate and scale. The setup is free, and the free trial does not require coding – you can start in days, not weeks, and realize ROI quickly – users report payback in less than 7 months. Bloggers might want to use Starter for coordinating merch expenses, while small businesses will appreciate Pro’s payment features. The pro plans deal with large multi-entity operations. It boasts fast 5X processing and 85% no-touch rate, and its low price is a steal for expanding teams, the web reviews claim.Try Vic.ai Free.

The custom pricing ensures flexibility, but the lack of transparency may deter some users. Compared to competitors like Bill.com, Vic.ai’s AI-driven autonomy and 97% out-of-the-box accuracy offer unique value, especially for complex workflows.

Pros & Cons

Here’s an evenhanded bill of particulars against Vic.ai

Pros:

- Saves Time: 80% fast processing of invoices and 85% no-touch automation.

- 99% Invoice Accuracy: Eliminate costly mistakes with 99% accuracy.

- Scalable: No challenge with multi-entity setups and high number of invoices.

- ERP Integration: Integrates easily with NetSuite, QuickBooks, and others.

- In-the-Moment Intelligence: Analytics enable better financial decisions.

Cons:

- Opaque Pricing: No public pricing, must contact for quote and schedule a demo call.

- An Expensive Option for Solopreneurs: $500+ per month upwards can be unaffordable for small users.

- Learning Curve: Beginners can be bogged down by some advanced features such as VicAgents.

Vic.ai is a pioneer in AP automation, but there’s no one-size-fits-all solution. For budget conscious bloggers and very small startups, there are simpler tools like Bill.com might be enough. Yet for most growing businesses, Vic.ai’s ROI and scalability make up for the cons.

Who Should Use Vic.ai?

Vic.ai is perfect for small business, bloggers dealing with rising expenses, and entrepreneurs who want to automate accounts payable or get insights. It’s perfect for:

- Bloggers: Manage merch or affiliate expenses with automatic invoice processing.

- Small Business: Keeping up with the volume of invoices and vendor payments, with the power of AI.

- Freelancers: Client AP system implementation with no-code ERP integrations.

- Startups: Scale operations with real-time spend visibility and fraud protection.

Vic.ai excels in industries like manufacturing and freight, where complex invoicing is common, and its fraud detection capabilities add value for high-risk sectors. It’s less ideal for businesses needing only basic payment scheduling.

Conclusion & Call to Action

Vic.ai is the disruptor for finance professionals willing to say goodbye to manual AP and hello to AI automation. With nearly 100% accuracy, 85% no-touch processing and easy ERP integrations, it’s a bloggers, entrepreneurs and small businesses’ choice for 2025. Though pricing isn’t transparent and can be expensive for solopreneurs, a free trial and proven ROI — saving clients $188 million by six million hours — make it a no-brainer for growing teams. Ready to remodel your AP process? Start your Vic.ai free trial

Affiliate Disclosure

This post contains affiliate links, meaning DigitalToolPro.com may earn a small commission on purchases made through them, at no additional cost to you. We only recommend tools that benefit entrepreneurs, bloggers, and small businesses like yours—thank you for your support!